Carbon Dioxide Removals, a UK perspective

Carbon credits generated through carbon dioxide removals (CDR) represent a removal of one metric tonne of CO2 emissions from the atmosphere. These removals will play an important role in achieving the goals set out in Nationally Determined Contributions (NDCs) under the Paris Agreement. NDCs are commitments by countries to reduce national emissions and adapt to the impacts of climate change.

Last year, at COP29, the UK unveiled its 2035 NDC, pledging an 81% reduction in economy-wide GHG emissions by 2035 from 1990 levels, excluding international aviation and shipping. COP29 also oversaw the full operationalisation of Article 6 of the Paris Agreement, enables countries to trade credits, aiding mutual NDC achievement.

There are two primary types of carbon markets: the compliance market and the Voluntary Carbon Market (VCM). The compliance market is regulated by regimes such as the UK Emissions Trading Scheme (UK ETS), where GHG emissions are capped, and surplus allowances can be traded. In contrast, the VCM is driven by corporate social responsibility and investor pressures to offset emissions and achieve sustainability targets.

Crucial to the strength of Voluntary Carbon Markets are the need for integrity standards to ensure that carbon offsets achieve their claimed environmental benefits. More recently, there have been critiques of some projects generating carbon credits, calling into question the integrity of these markets1. The Integrity Council for the Voluntary Carbon Market (ICVCM) and the Voluntary Carbon Markets Integrity Initiative (VCMI) are key endeavours aiming to ensure integrity within the VCM by developing minimum global quality thresholds and good practice for the supply and use of voluntary carbon credits.

Global carbon markets are likely to experience significant growth by 2050. Key drivers of this growth are ambitious carbon neutrality targets from various market participants, including project developers, corporations, non-profits, governments, brokers, and traders. Verification and registry bodies ensure transparency, due diligence, and verifiability. Registries and rating agencies play a crucial role in the carbon market. Registries ensure that each carbon credit is uniquely identified, tracked, and retired once used, preventing double counting and potential for fraud. Rating agencies assess the quality and credibility of carbon projects, providing transparency and confidence to buyers. Projects sell credits to fund their initiatives, enabling them to continue their environmental and social efforts.

Carbon removals are typically grouped as nature-based and engineered solutions. Nature-based credits result from reforestation and soil management projects that utilise natural processes to reduce GHGs. Engineered solutions rely on technologies such as Carbon Capture and Storage (CCS), typically Bioenergy with Carbon Capture and Storage (BECCS) or Direct Air Capture with Carbon Storage (DACCS). These technologies, though promising, face hurdles - Direct Air Capture costs remain high. For BECCS, sustainable sourcing of biomass is critical to deliver true removals, ensuring operators comply to strict sustainability criteria will be challenging, where non-sustainable sourcing is reported to have occurred to date2.

UK developments

The UK government has ambitious aims to deploy at least 5 MtCO2/yr of engineered removals by 2030, scaling up to around 75-81MtCO₂/year by 2050. Currently the UK pipeline of projects suggests that the 2030 target will be challenging to achieve. As well as these aims, the UK ETS authority is considering the inclusion of engineered removals within the UK ETS, aiming to incentivise investment and provide a source of demand for removals from polluting sectors, subject to robust monitoring, reporting, and verification (MRV) and the management of any wider impacts. A consultation was published in 2024, with the government response yet to be finalised. The UK Government have also recently published its own principles for the integrity of the voluntary carbon and nature market, with a focus on the need for the use of high integrity credits3.

In addition, the UK is consulting on implementing a Carbon Border Adjustment Mechanism (CBAM), which is another critical element in this landscape. CBAM aims to ensure that importers pay the same carbon price as domestic producers under the UK ETS, thereby preventing carbon leakage and ensuring equal treatment for products made in the UK and imports from elsewhere. This mechanism will motivate importers to decarbonise their supply chains to remain competitive. Furthermore, the UK's CBAM is designed to align with similar measures being implemented by the EU, promoting a cohesive approach to carbon pricing across Europe.

As well as this, the UK government, in collaboration with the British Standards Institute (BSI) are developing technology specific methodologies for engineered removals (such as BECCS and DACCS) to define the requirements around the quantification and MRV. Ensuring that carbon offsets achieve their claimed environmental benefits is crucial. As the energy transition develops, VCMs must address concerns around market strength, scalability, maturity, and integrity.

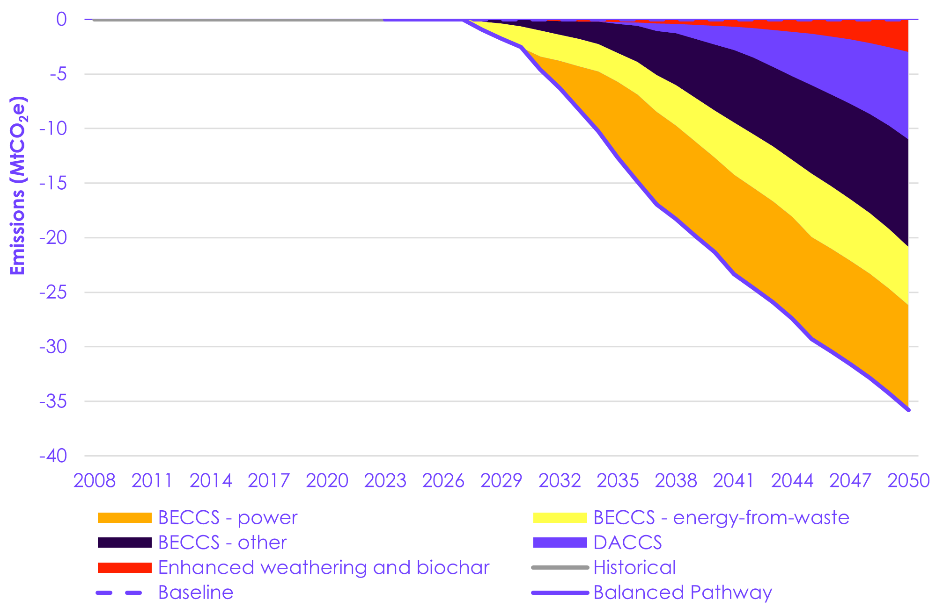

More recently, the Climate Change Committee (CCC) published the Seventh Carbon Budget (CB7), outlining a pathway to further reducing UK emissions between 2038 and 2042. The ambitious recommendation from the CCC is to limit GHGs to 535 MtCO2e. The ‘balanced pathway’ developed by the CCC includes carbon removals, with CB7 seeing the inclusion of more CDR methods, such as Biochar and Enhanced Rock Weathering (ERW) both providing 3% (0.6 Mt) of removals in 2040, growing to 8% (3 Mt) in 2050.

Figure 1: Source of abatement in the balanced pathway for engineered removals, from the CCC4

Overall, the contribution of removals has decreased compared to the previous budget, where the Sixth Carbon Budget (CB6) suggested residual emissions addressed by removals would be 58 MtCO2e compared to 35.8 MtCO2e in CB7. This change is in part due to changes in emissions accounting and inventory reporting in various sectors, including land use and agriculture. As well as a move away from biomass imports due to concerns about sustainability standards, resulting in the level of BECCS in CB7 being 50% lower in 2050 than CB6. DACCS sees an increased share in overall removals, with 8% (1.7 Mt) of removals in 2040 growing to 22% (8 Mt) in 2050. This is significantly more ambitious than our forecast of 1.87 Mt from DACCS by 2050, in our recently published 2025 UK Energy Transition Outlook5.

Developments Globally

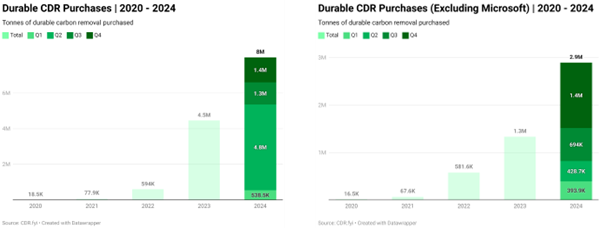

To date, the VCM is driving the uptake of CDR globally with around 8 Mt of removal purchased in 2024, a 78% increase over 2023. Of these purchases, the largest volumes were purchases related to DACCS and BECCS. Whilst the growth in the VCM is positive, it is important to highlight that current purchases are driven by a small number of buyers mainly Microsoft and Frontier6 (membership includes Stripe, Google, Shopify and others). As well as this, the number of credits delivered compared to those sold remains low, at roughly 4.4% of booked volumes delivered in 20247.

Figure 2: Durable carbon removal purchases (left), durable carbon removal purchases excluding Microsoft (right), from CDR.FYI8

The new administration in the United States has come with a shift in focus away from climate action as Trump has again withdrawn from the Paris Agreement. As well as this, the ‘Unleashing American Energy’ act has resulted in pauses to funding under the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL) implemented under the previous Biden administration. This has raised uncertainty around the future of the updates to the 45Q tax credit introduced in the IRA, in particular the $180/tCO2 credit for DACCS and the BIL funding for Direct Air Capture hubs. While the US has been seen as a global leader in the development of the CDR industry, with 35% of jobs created in the US9, these changes may see investments in CDR shift to regions who remain committed to addressing climate action and moving forward with the energy transition.

Closer to home, in Europe, the Industrial Carbon Management strategy outlined the EU’s need to scale up carbon removals, in line with the European Green Deal and European Climate Law objectives. The commission aims to develop policy options and support mechanisms for industrial carbon removals. At the end of 2024, an EU-wide framework for the certification of carbon removals was published, namely the Carbon Removals and Carbon Farming Certification (CRCF) Regulation10. The CRCF considers permanent carbon removals (DACCS, BECCS) and ultimately is part of measures to meet the objectives and targets laid down in Regulation (EU) 2021/1119 Reduction of emissions to net zero by 2050.

In Conclusion

In conclusion, robust standards, a stable and high carbon price, along with carbon leakage protections, and reductions in the levelised cost of averting carbon for engineered solutions are required to create a competitive commercial market where GGR projects are developed without the need for government support. The evolving landscape of carbon markets presents both challenges and opportunities, however the UK can lead the way in creating a credible and effective carbon market with government focussed on the integrity of removals generated.

Looking further ahead, the carbon credit market is expected to grow significantly over the next decade, helped by the operationalisation of Article 6. Increased regulatory frameworks, technological advancements, country-to-country carbon trading and corporate commitments to sustainability will likely drive this expansion. As markets mature, we can anticipate more stringent verification processes and greater transparency, ensuring that carbon credits effectively contribute to global emission reduction goals. DNV remains committed to supporting organisations on this collective journey.

Co-authored by Ali Daoud and Robert Maxwell.

References

[1] https://dialogue.earth/en/climate/phantom-rice-projects-expose-voluntary-carbon-market-failings/

[2] https://www.bbc.com/news/articles/c9qg5v7n9rgo

[3] High integrity criteria defined by DESNZ includes activity additional to that required by law at project level, application of conservative baselines, no double counting, independently validated and verified, with measures to compensate from any reversals. https://www.gov.uk/government/publications/voluntary-carbon-and-nature-market-integrity-uk-government-principles/principles-for-voluntary-carbon-and-nature-market-integrity

[4] https://www.theccc.org.uk/publication/the-seventh-carbon-budget/

[5] https://www.dnv.com/energy-transition-outlook/uk/

[6] Frontier is an advance market commitment to accelerate carbon removals, members include Google, Shopify, Stripe and others, https://frontierclimate.com/

[7] https://www.cdr.fyi/blog/2024-year-in-review

[8] https://www.cdr.fyi/blog/2024-year-in-review

[9] https://www.carbonfuture.earth/magazine/carbon-removal-policy-in-trumps-second-term-what-to-expect

[10] Regulation (EU) 2024/3012 of the European Parliament and of the Council of 27 November 2024 establishing a Union certification framework for permanent carbon removals, carbon farming and carbon storage in products

18/03/2025 16:48:00